audius continues strong growth – total output up +20.1%

Biographie

Wolfgang Wagner ist seit 2016 im Vorstand der audius Gruppe und verantwortet dort die Bereiche M&A, Investor Relations und HR sowie diverse Querschnittsfunktionen. Zahlen und Finanzen nahmen fortwährend sehr viel Raum in seiner Karriere als Diplom Betriebswirt, Bankkaufmann und Bilanzbuchhalter ein. Dieses Wissen hat er in den vergangenen 20 Jahren in verschiedensten Funktionen in Unternehmen und auch in selbständiger Beratung stetig vertieft.

audius continues strong growth

Normaler Abstand nach oben

Normaler Abstand nach unten

audius continues strong growth – total output up +20.1%

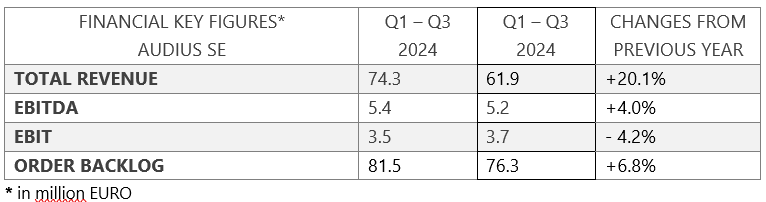

• Total revenue in the third quarter rises by 24.8% to EUR 26.8 million (previous year: EUR 21.5 million)

• EBITDA in the third quarter shows a clearly positive development, rising by 25.3% to EUR 2.6 million (previous year: EUR 2.1 million)

• Growth in total revenue after nine months up 20.1% to €74.3 million (previous year: €61.9 million), EBITDA at €5.4 million

• Targets for the full year confirmed

Weinstadt, 21.11.2025

The audius Group looks back on a very successful third quarter with dynamic growth of 24.8% compared to Q3 2024. For the year as a whole, the Group's growth stands at 20.1% and was achieved almost entirely organically.

According to unaudited figures, total revenue in the first nine months increased by €12.4 million to €74.3 million (total revenue for the first nine months of 2024: €61.9 million). Total revenue in the third quarter was €26.8 million (total output Q3 2024: €21.5 million). Purely organic growth in the third quarter was around 22%, with an overall jump of 24.8%.

At €5.4 million, EBITDA after nine months was above the previous year's level (EBITDA for the first nine months of 2024: EUR 5.2 million) and continues the positive development in 2025. Particularly noteworthy is the EBITDA for the third quarter, which rose by around 25% to EUR 2.6 million, marking a new record high. As in the previous year, the EBITDA margin in the third quarter was 9.6%. EBIT after nine months was EUR 3.5 million (EBIT 9 months 2024: EUR 3.7 million). The higher depreciation and amortization are primarily attributable to a further increase in goodwill amortization and various investments in the company's own infrastructure.

The order backlog as of September 30, 2025 grew significantly compared to the previous year, reaching around €81.5 million (as of September 30, 2024: €76.3 million). Including orders from CompuSafe, the order backlog amounts to around €94 million.

audius was thus able to grow significantly in both the second and third quarters and is showing a clear improvement in margins. Additional growth in total revenue and earnings will be added in the following quarters from this year's two successful acquisitions, Ergonomics and CompuSafe (consolidation from October 1, 2025).

The company therefore confirms its forecast for the current fiscal year of total revenue of more than €100 million and EBITDA of more than €8 million.

About audius

The audius ICT group was founded in 1991 and operates with around 900 employees at over 20 locations worldwide with a focus on the DACH region.

The portfolio comprises 3 business units: IT Services and Software/Cloud with customized solutions for public clients, SMEs and international corporations, as well as Telecommunications with a focus on network infrastructures and the development and expansion of the 5G network.

audius' customers include global corporations and medium-sized companies, and the focus of its support is on the use of future-oriented technologies such as artificial intelligence and best practices. The strategic goal is to grow both organically and through acquisitions.

The shares of audius SE are listed on the Basic Board of the Frankfurt Stock Exchange and in the m:access SME segment of the Munich Stock Exchange.

For further information please contact

audius SE

Investor Relations

t.: +49 7151 369 00 359

ir@audius.de

https://www.audius.de/en