+49 (7151) 369 00 - 364

Mehr erfahren

Since 2020, Melanie Ilg is supporting audius in the area of investor relations and corporate development.

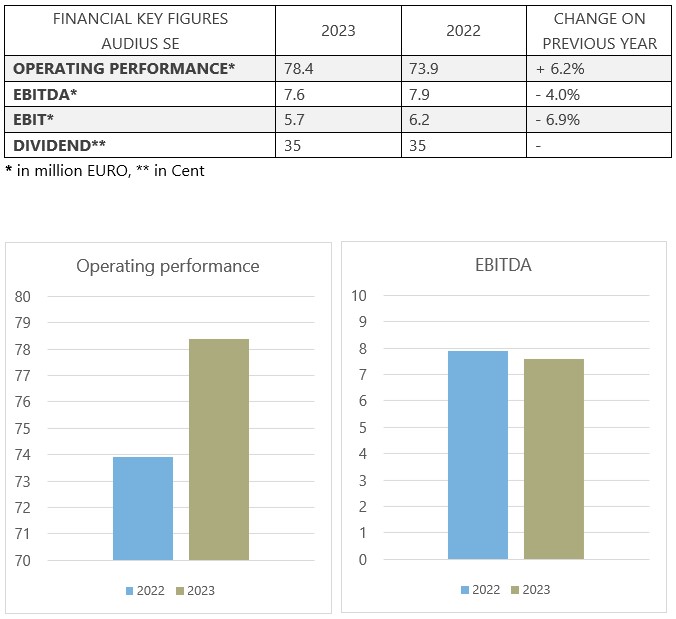

audius publishes its annual report for 2023 and proposes a dividend of 35 cents per share

- Total operating performance in financial year 2023 increases to EUR 78.4 million (previous year: EUR 73.9 million)

- EBITDA and EBIT slightly below previous year's level: EBITDA EUR 7.6 million (previous year: EUR 7.9 million), EBIT EUR 5.7 million (previous year: EUR 6.2 million)

- Management Board and Supervisory Board propose a dividend of 35 cents per share

- Year 2024 starts with high order intake

Weinstadt, April 24, 2024. Today audius SE published its annual report for the past financial year, confirming the previously announced business figures.

According to the report, the audius Group achieved a total operating performance of EUR 78.4 million, an increase of 6% (previous year: EUR 73.4 million). At EUR 7.6 million, the operating result (EBITDA) was only 4% lower than in the previous year (previous year: EUR 7.9 million).

The main reasons for the decline in the margin were the disproportionately high increase in personnel costs and other operating expenses in relation to total operating performance. In addition to the general cost increases, audius invested heavily in the development of new future-oriented topics in the reporting year, such as the new Mobile Device Management business and the development of product solutions in combination with artificial intelligence approaches. At the same time, the Group has also positioned itself for further growth in the coming years by investing in its own organization.

Group EBIT amounted to EUR 5.7 million and was slightly below the previous year (previous year: EUR 6.2 million). At EUR 3.5 million, the consolidated net profit for the year was slightly below the previous year's figure of EUR 3.8 million. As the profit attributable to minority interests decreased, the net profit for the year after minority interests of EUR 3.4 million remained almost at the previous year's level of EUR 3.5 million. Cash flow from operating activities developed positively and increased to EUR 2.9 million (previous year: EUR 2.5 million).

The equity ratio on the balance sheet date increased compared to the previous year and was an extremely good 63.3% (previous year: 58.4%). The Group's cash and cash equivalents amounted to EUR 10.0 million, meaning that audius continues to have a high level of net liquidity.

The order backlog as at December 31, 2023 increased significantly once again to EUR 56.8 million (previous year: EUR 50.3 million).

The Executive Board and Supervisory Board of audius SE will propose an unchanged dividend of EUR 0.35 per share for the 2023 financial year at the Annual General Meeting on June 26, 2024. Shareholders will thus once again participate directly in the company's success. The company's Annual General Meeting will this year be held in Waiblingen and once again as an in-person event.

While the first quarter of the current financial year was still characterized by start-up investments, audius succeeded in increasing incoming orders in the first few months of the year. These relate to both the extension of existing business and new orders. The long-term orders will once again significantly increase the order backlog at the end of the first quarter and first half of the year and secure future growth and an increasing profit margin for the Group. The Management Board is therefore very optimistic about achieving its planned targets, both for the current year and for the medium-term forecast of revenue of more than EUR 115 million in 2026.

The audius SE annual report is now available for download on the company's website.